Paywall Reader | Read without paywalls for free vs. BondSmartly

Paywall Reader | Read without paywalls for free

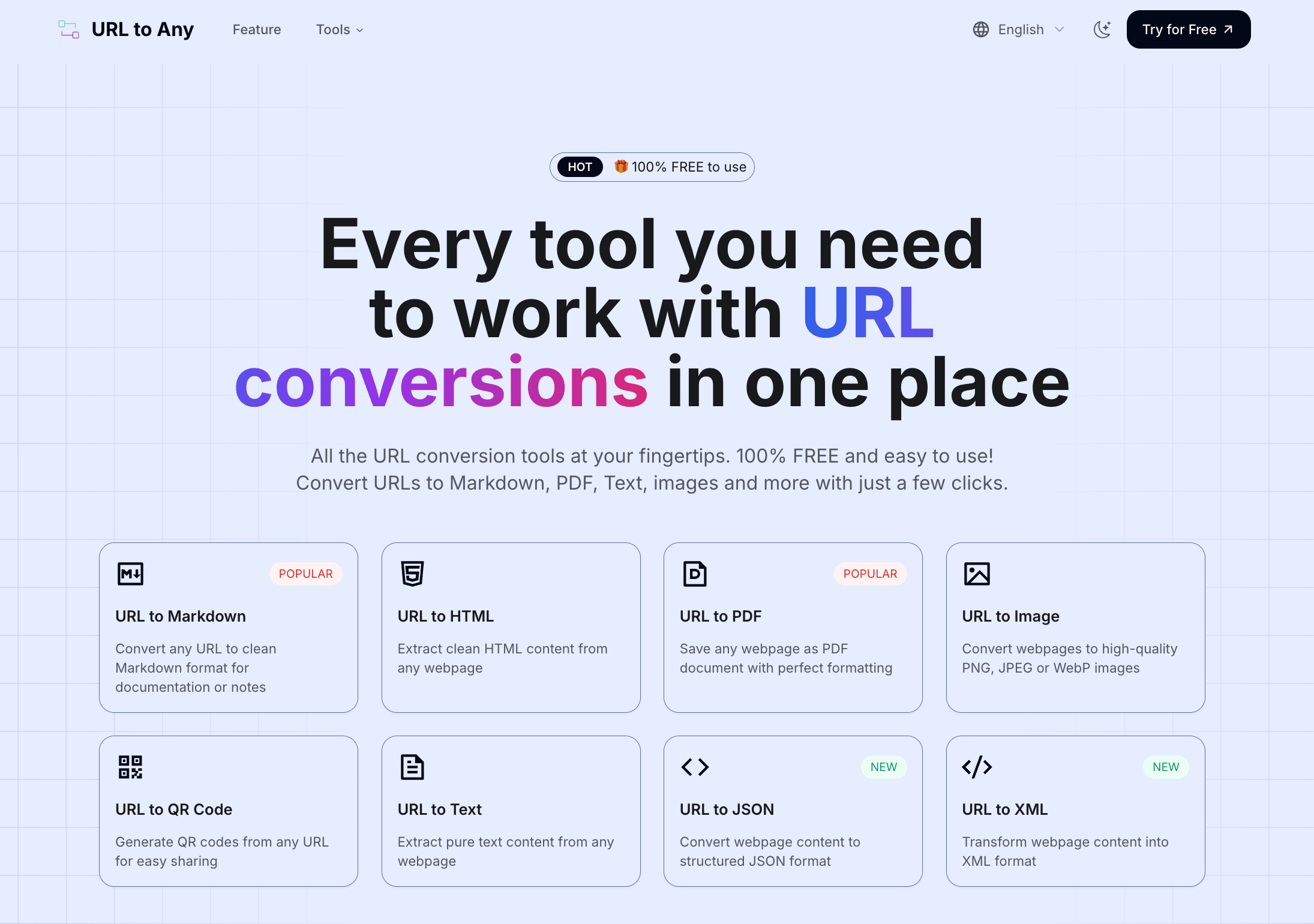

Paywall Reader is a tool that helps you read articles blocked by paywalls. It doesn’t hack into sites or break paywalls directly. Instead, it sends you to archived or cached versions of the page. These versions are saved copies from places like Archive.Today, the Internet Archive, or even Google Translate. It works best with soft paywalls—those pop-ups that block the screen but still have the full text underneath. To use it, you just paste the article’s URL, pick an option from the three services, and it tries to find a version without the paywall. If one doesn’t work, you can try another. Not every paywall can be bypassed, especially if a site blocks archiving, but most major news sources work fine. It’s considered legal because it doesn’t tamper with the website itself—it just finds copies that are already available online. People use it to access news without needing tons of subscriptions or for things like schoolwork and research. The site isn’t connected to any of the archive se...

BondSmartly

BondSmartly.com is a platform designed to streamline bond investment decisions by offering access to yield curves of over 500,000 bonds. It provides users with comprehensive search filters, allowing them to discover using a powerful bonds screener based on various parameters such as ISIN, issuer, coupon rate, and maturity date. Investors can utilize the yield curve data to analyze different bonds and make informed choices. Additionally, the platform features tools like a YTM (Yield to Maturity) calculator and bond screener, making it an all-in-one resource for bond market insights and analytics. With these features, BondSmartly helps investors optimize their portfolios with precision and ease.

Reviews

Reviews

| Item | Votes | Upvote |

|---|---|---|

| fast | 1 | |

| lightweight | 1 | |

| minimalist | 1 |

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| Prices for over 500.000 bonds | 1 | |

| Bonds screener | 1 | |

| Reference data for bonds of all types | 1 | |

| Yield curves for all bonds by one issuer. | 1 |

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

Frequently Asked Questions

Paywall Reader and BondSmartly serve entirely different purposes. Paywall Reader is designed to bypass paywalls, allowing users to access articles and content for free. On the other hand, BondSmartly is a specialized platform for bond investors, offering tools like bond screeners, yield curves, and comprehensive data for over 500,000 bonds. If you are looking for financial analysis and bond investment tools, BondSmartly is the better choice. However, if your goal is to access restricted articles and content for free, then Paywall Reader would be more suitable.

Yes, BondSmartly is more useful for investors. It provides a wide range of tools specifically designed for bond market analysis, including a bond screener, yield curves, and reference data for over 500,000 bonds. Paywall Reader, on the other hand, is intended for bypassing paywalls to access restricted articles and content. Therefore, BondSmartly is the preferred choice for investors seeking to optimize their portfolios and make informed bond investment decisions.

Paywall Reader is described as fast, lightweight, and minimalist, making it a simpler tool compared to BondSmartly. BondSmartly is a comprehensive platform with a variety of features aimed at bond investors, which means it may be more complex and data-heavy. If you prefer a lightweight and minimalist tool, Paywall Reader would be the better option.

Paywall Reader is a tool that allows users to read articles that are blocked by paywalls. It does not hack into websites or break paywalls directly; instead, it provides access to archived or cached versions of the page from sources like Archive.Today, the Internet Archive, or Google Translate. It is particularly effective with soft paywalls, which are pop-ups that block the screen but still allow access to the full text underneath.

To use Paywall Reader, you simply paste the URL of the article you want to read, select one of the three available services, and it attempts to find a version of the article without the paywall. If the first option does not work, you can try another service. While it works well with many major news sources, not every paywall can be bypassed, especially if a site blocks archiving.

The pros of Paywall Reader include its speed, lightweight design, and minimalist interface, making it easy to use. There are currently no listed cons for Paywall Reader, as it is designed to provide a straightforward solution for accessing paywalled content legally.

Yes, using Paywall Reader is considered legal because it does not tamper with the website itself. It simply finds copies of articles that are already available online through archived versions. However, users are responsible for how they use the tool.

Paywall Reader is beneficial for anyone looking to access news articles without needing multiple subscriptions. It is particularly useful for students and researchers who need access to various articles for schoolwork or research purposes.

BondSmartly.com is a platform designed to streamline bond investment decisions by offering access to yield curves of over 500,000 bonds. It provides users with comprehensive search filters, allowing them to discover using a powerful bonds screener based on various parameters such as ISIN, issuer, coupon rate, and maturity date. Investors can utilize the yield curve data to analyze different bonds and make informed choices. Additionally, the platform features tools like a YTM (Yield to Maturity) calculator and bond screener, making it an all-in-one resource for bond market insights and analytics.

Pros of BondSmartly include prices for over 500,000 bonds, a powerful bonds screener, reference data for bonds of all types, and yield curves for all bonds by one issuer. There are no user-generated cons at this time.

BondSmartly offers several features including a powerful bonds screener based on parameters such as ISIN, issuer, coupon rate, and maturity date. It also provides yield curves for over 500,000 bonds, reference data for bonds of all types, and tools like a YTM (Yield to Maturity) calculator.

BondSmartly helps investors by providing comprehensive tools and data to make informed bond investment decisions. Users can access yield curves for over 500,000 bonds, use a powerful bonds screener to filter based on various parameters, and utilize tools like the YTM calculator to analyze different bonds. This enables investors to optimize their portfolios with precision and ease.