Endura vs. BondSmartly

Endura

Endura is the first comprehensive digital estate planning platform specifically designed to assist individuals and families in securely managing, storing, and distributing their digital assets. In an era where our lives are increasingly tied to the digital world, Endura offers a sophisticated and modern solution for managing online accounts, documents, and electronic assets. This platform ensures that these important digital possessions are handled according to an individual's specific wishes after their passing, providing peace of mind and security. An individual can upload their digital assets, assign beneficiaries to those assets, and invite executors to carry out their wishes on the platform. Whether you're organizing your personal digital life or offering professional estate planning services, Endura empowers you to manage and protect digital legacies effectively. This makes it an essential tool in the modern age, where digital assets are as important as physical ones.

BondSmartly

BondSmartly.com is a platform designed to streamline bond investment decisions by offering access to yield curves of over 500,000 bonds. It provides users with comprehensive search filters, allowing them to discover using a powerful bonds screener based on various parameters such as ISIN, issuer, coupon rate, and maturity date. Investors can utilize the yield curve data to analyze different bonds and make informed choices. Additionally, the platform features tools like a YTM (Yield to Maturity) calculator and bond screener, making it an all-in-one resource for bond market insights and analytics. With these features, BondSmartly helps investors optimize their portfolios with precision and ease.

Reviews

Reviews

| Item | Votes | Upvote |

|---|---|---|

| Secure Document Storage | 1 | |

| Comprehensive Beneficiary Management | 1 | |

| Executor Control | 1 | |

| User-Friendly Interface | 1 |

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| Prices for over 500.000 bonds | 1 | |

| Bonds screener | 1 | |

| Reference data for bonds of all types | 1 | |

| Yield curves for all bonds by one issuer. | 1 |

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

Frequently Asked Questions

Endura is specifically designed for digital estate planning, allowing users to securely manage, store, and distribute digital assets. It includes features like secure document storage, comprehensive beneficiary management, and executor control. BondSmartly, on the other hand, is focused on bond investments, offering tools such as a bonds screener, yield curve data, and a YTM calculator to help investors make informed decisions. For managing digital assets, Endura is the better choice due to its dedicated focus on digital estate planning.

BondSmartly is tailored for investors looking to optimize their bond portfolios. It provides access to yield curves of over 500,000 bonds, a powerful bond screener, and tools like a YTM calculator. Endura, on the other hand, is focused on digital estate planning, helping users manage and distribute digital assets. For making informed investment decisions, BondSmartly is the superior option due to its comprehensive investment tools and data.

Endura specializes in digital estate planning, providing tools for managing, storing, and distributing digital assets with features like secure document storage and executor control. BondSmartly focuses on bond investments, offering a wide array of financial tools such as a bond screener, yield curve data, and a YTM calculator. Therefore, BondSmartly offers better tools for financial management related to bond investments, while Endura excels in managing digital estates.

Endura is the first comprehensive digital estate planning platform specifically designed to assist individuals and families in securely managing, storing, and distributing their digital assets. This platform ensures that important digital possessions are handled according to an individual's specific wishes after their passing, providing peace of mind and security.

Endura offers secure document storage, comprehensive beneficiary management, executor control, and a user-friendly interface. These features help individuals organize, manage, and protect their digital legacies effectively.

Pros of Endura include secure document storage, comprehensive beneficiary management, executor control, and a user-friendly interface. Currently, there are no user-generated cons listed for Endura.

Endura helps with digital estate planning by allowing individuals to upload their digital assets, assign beneficiaries to those assets, and invite executors to carry out their wishes on the platform. This ensures that digital possessions are managed and distributed according to the individual's specific wishes after their passing.

BondSmartly.com is a platform designed to streamline bond investment decisions by offering access to yield curves of over 500,000 bonds. It provides users with comprehensive search filters, allowing them to discover using a powerful bonds screener based on various parameters such as ISIN, issuer, coupon rate, and maturity date. Investors can utilize the yield curve data to analyze different bonds and make informed choices. Additionally, the platform features tools like a YTM (Yield to Maturity) calculator and bond screener, making it an all-in-one resource for bond market insights and analytics.

Pros of BondSmartly include prices for over 500,000 bonds, a powerful bonds screener, reference data for bonds of all types, and yield curves for all bonds by one issuer. There are no user-generated cons at this time.

BondSmartly offers several features including a powerful bonds screener based on parameters such as ISIN, issuer, coupon rate, and maturity date. It also provides yield curves for over 500,000 bonds, reference data for bonds of all types, and tools like a YTM (Yield to Maturity) calculator.

BondSmartly helps investors by providing comprehensive tools and data to make informed bond investment decisions. Users can access yield curves for over 500,000 bonds, use a powerful bonds screener to filter based on various parameters, and utilize tools like the YTM calculator to analyze different bonds. This enables investors to optimize their portfolios with precision and ease.

Related Content & Alternatives

- 0

15.BigSpy

15.BigSpyBigSpy possesses a massive database that undergoes millions of data updates every day. Moreover, BigSpy's database covers some of the most crucial platforms highly regarded by advertising practitioners, such as TikTok, Facebook, and Admob. With its abundant filtering options, you can effortlessly find the advertising materials that best meet your needs and gain inspiration. The homepage analysis function enables real-time monitoring of competitors. In addition, BigSpy offers features like selected advertisements and creative rankings, further helping you pick out the most valuable advertising creativity and greatly enhancing your efficiency in finding advertising inspiration.

- 0

23.KarmaLinks

23.KarmaLinksKarmaLinks is an AI powered backlink exchange platform. Users are able receive backlinks from others and must give backlinks in exchange. Matchings are done by AI and guarantee the best quality and relevance. Key Features Backlink exchange: give backlinks, receive karma points by the amount of your Domain Rating; Receive backlink, points are reduced by the amount of the website's Domain Rating that gave you the backlink. Backlink monitoring: Automatically monitors that the backlinks you received are still available to keep your DR high. Benefits - SEO: grow your domain authority, rank better - Free: you have nothing to pay to join and use the platform. - Privacy: our community is not a database. The algorithm finds you the relevant backlinks to give/receive once a week. - Efficient process: remember the time where you did endless outbound to gather poor quality backlinks? This is now history. - Quality: our algorithm uses AI to find you the best match for each backlink it suggests. - Non penalising: The domains and the identity of domain owners are strongly verified (Using AI and human manual validation). We don't let scam websites or link farms join the platform. Use Case For marketing teams and SaaS founders: use our platform to rank your website higher thanks to our free backlink exchange platform. For SEO pros (consultants and agencies): use our platform to scale the link building strategy of your clients.

- 0

14.Your Next Domain

14.Your Next DomainYourNextDomain helps you find a great dot com for your business. It's no secret dot com is still king. Customers trust the .com at the end because they think it was hard to get. But it's easier than you think with YourNextDomain. The perfect dot com could slip through your fingers at any moment. Millions of domains go to auction every day scattered across the internet. Use our all-in-one site to find the best opportunities to help you build the authoritative brand your business deserves. Find expiring domains with years of history to give you a head start on SEO. A fast, flexible, intuitive search helps you focus on only domain names that are a fit for you. Bookmark all searches and return to them later. Best of all, no login required. Start searching now!

- 0

19.DigitalGondola

19.DigitalGondolaThe source of truth for Software-as-a-Service buying advice. Over 750+ SaaS, Micro-SaaS & Digital Services reviewed, compared, and analyzed.

- 0

21.Plotzy

21.PlotzyPlotzy is a robust software platform purpose-built for the commercial real estate industry, delivering the tools professionals need to make informed decisions faster. Key Features: Find property info from county tax assessors Find owner contact information Zoning questions answered, instantly & accurately Search for properties by permitted use by right & conditionally Organize your lists Export your data By aggregating diverse property data from multiple sources, Plotzy offers a comprehensive view of the real estate landscape, including detailed insights into owner contact information, zoning laws, and municipal resources.

- 0

45.Coin Newsify

45.Coin NewsifyCoin Newsify is an AI-powered platform that rapidly identifies, gathers, categorizes, and labels cryptocurrency news from various sources, including news sites and social media platforms like X Corp. Coin Newsify filters out irrelevant content, advertisements, and duplicate news, ensuring users receive only the most significant and timely information that could impact market prices. The filtering mechanism helps users focus on what truly matters. Coin Newsify helps users personalize their news experience by setting up follow and notification preferences based on cryptocurrencies, markets, tags, or specific news sources. This customization allows users to tailor their feed to their specific interests and needs. Coin Newsify also enhances decision-making with features like AI-generated summaries, sentiment analysis, and integrated price charts, providing traders with a comprehensive toolkit to navigate the crypto market effectively. How it works: 1. Register via our web or mobile app. 2. Configure your follow and notification settings in the settings page. 3. Personalize your experience by selecting preferences across currencies, markets, listings, and tags. 4. Receive Notifications according to your settings. 5. Stay Informed by checking your customized feed for the latest market news.

- 0

2.Solana Tracker

2.Solana TrackerSolana Tracker is a platform for Traders and Solana Developers. Everything from buying memecoins to building your own web3 app on Solana. Quick Discovery: Find new memecoins fast on popular exchanges like Raydium, Pumpfun, Moonshot, and Orca. No more endless scrolling or missed opportunities. Safety First: Every token gets an automatic rugcheck. This helps you assess risks quickly and invest with more confidence. Easy Portfolio Management: Keep an eye on multiple wallets at once and see your daily profit and loss. It's like having a personal finance dashboard for your Solana investments. Developer Friendly: Building on Solana? Solana Tracker provides handy resources like Swap API, Data API, and Solana RPC nodes to make your life easier. Whether you're a casual investor or a serious developer, Solana Tracker simplifies your Solana token experience. It's designed to help you find, buy, and track tokens more efficiently. Give it a try and see how it can streamline your Solana journey.

- 0

3.Foundy.com

3.Foundy.comFoundy.com is the first AI-enabled platform specialising in long-term exit planning and successful M&A deal execution. Whether you're preparing for an exit within 1 to 36 months or exploring buy-side acquisition opportunities, Foundy offers an AI-powered SaaS platform combined with expert advisors who specialise in your company’s industry niche. We provide a comprehensive toolkit, including buyer and deal flow sourcing, templates and access to a thriving community of exited founders and buyers, all designed to maximise shareholder value and ensure a successful transaction. Foundy also has a generous referral programme for those who connect us with buyers or sellers.

- 0

9.Gain Full Control Over Your Content with PeakD’s Unique Features

9.Gain Full Control Over Your Content with PeakD’s Unique FeaturesHighlighting the risk of dependency on traditional social media platforms, the video advocates for the use of email lists which provide a more stable and controlled medium for reaching out to an audience. It transitions into discussing the merits of PeakD, a decentralized platform that offers true ownership and greater security for its users. Through a step-by-step demonstration, the video educates on how to create a PeakD account, stressing the importance of security practices such as safeguarding private keys. This summary is ideal for online marketers looking for robust alternatives to traditional social media to securely manage and own their digital content. Forge Your Digital Path with PeakD: True Ownership in Digital Marketing: https://www.youtube.com/watch?v=xwROTAKwcww

- 0

36.Shortimize

36.ShortimizeTrack, analyze, and explore TikTok, Insta Reels, and YouTube Shorts videos and accounts. Monitor your accounts across platforms and dive into viral content like never before. Access advanced data analysis and dashboards to keep track of your videos and identify outliers, creating a virality machine for your app or brand. Use AI to search through an extensive library of viral content. Search by context and hook to find the latest high-performing videos and get inspiration for your next short content. Discover similar viral videos to your own to enhance your content, and find accounts that mirror yours. Spy on and track your competition, uncover their viral content, and improve your own content strategy.

- 0

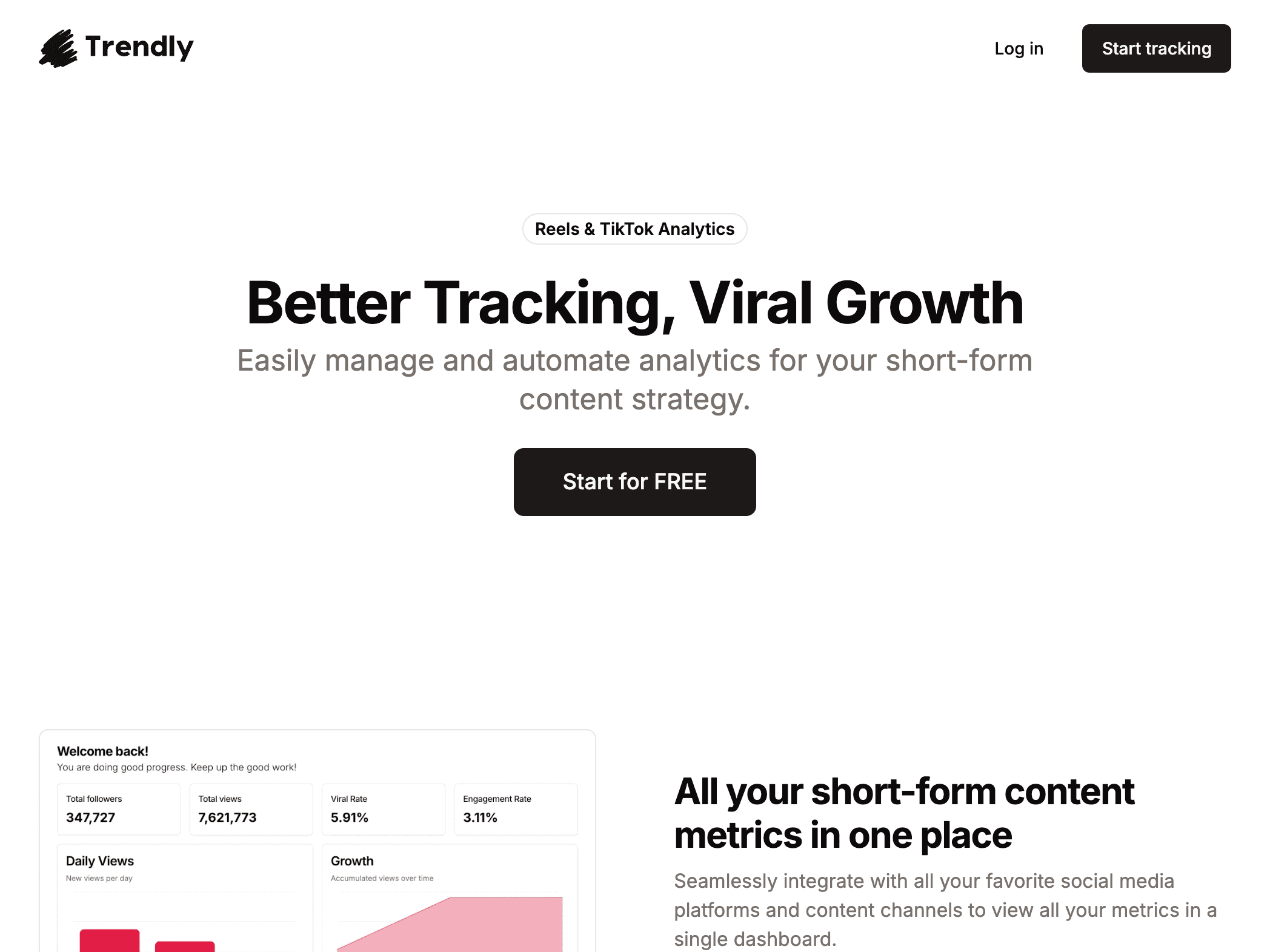

73.Trendly.so

73.Trendly.soTrendly is an advanced analytics platform that centralizes your short-form content metrics from TikTok, Instagram Reels, and YouTube Shorts. It helps creators optimize their content strategy by offering competitor insights, analyzing engagement through its unique Virality Factor.

- 0

5.Dynamiq

5.DynamiqDynamiq the operating platform for building, deploying, monitoring and fine-tuning generative AI applications. Key features: 🛠️ Workflows: Build GenAI workflows in a low-code interface to automate tasks at scale 🧠 Knowledge & RAG: Create custom RAG knowledge bases and deploy vector DBs in minutes 🤖 Agents Ops: Create custom LLM agents to solve complex task and connect them to your internal APIs 📈 Observability: Log all interactions, use large-scale LLM quality evaluations 🦺 Guardrails: Precise and reliable LLM outputs with pre-built validators, detection of sensitive content, and data leak prevention 📻 Fine-tuning: Fine-tune proprietary LLM models to make them your own Benefits: ⛑️ Air-gapped Solution: Dynamiq specializes in enabling clients that manage highly sensitive data to leverage LLMs while maintaining ironclad security thank to stringent security controls. 🕹️ Vendor-Agnostic: Through integration capabilities, our clients can build GenAI applications using a variety of models from providers such as OpenAI and have the flexibility to switch to other providers if needed. 🧲 All-In-One Solution: We cover the entire GenAI development process from ideation to deployment Use cases: 🏋️ AI Assistants: Equip your team with custom AI assistants that streamline tasks, enhance information access, and boost productivity 🧠 Knowledge Base: Build a dynamic AI knowledge base with our platform that streamlines decision-making, enhances productivity and allows employees to spend less time navigating through extensive company documents, files, and databases 🎢 Workflow Automations: Design powerful, no-code workflows that leverage your enterprise's knowledge to enhance content creation, CRM enrichment, and customer support.

- 1

4.Clerk

4.ClerkClerk is a comprehensive user management and authentication platform designed to streamline how developers handle user accounts within web and mobile applications. It offers a suite of embeddable UI components—such as <SignIn/>, <SignUp/>, <UserButton/>, and <UserProfile/>—that integrate seamlessly into your application without redirecting users off-site. These components are fully customizable to match your brand, making the user experience cohesive and frictionless. Under the hood, Clerk provides a robust API and SDKs compatible with modern frameworks like Next.js, Remix, React, and Expo. It handles the entire authentication lifecycle, supporting multifactor authentication (MFA), session management, passwordless sign-in (via magic links or one-time passcodes), and traditional password-based methods with breach detection. The platform also integrates social sign-on (SSO) with over 20 providers, enabling quick user onboarding while adhering to security best practices. Clerk’s security posture includes SOC 2 Type 2 certification and CCPA compliance, with continuous third-party audits and penetration testing. Fraud prevention measures, like disposable email blocking and bot detection powered by machine learning, are built-in to reduce spam and abusive sign-ups. For B2B SaaS applications, Clerk provides advanced multi-tenancy features, enabling organization-based user management with custom roles, permissions, auto-join functionality based on email domains, and invitation systems—all accessible through both code and an admin dashboard. Developers benefit from rapid integration, significantly reducing the time spent on building authentication systems from scratch. Clerk acts as the single source of truth for user data and integrates seamlessly with popular backend services like Supabase, Firebase, and Convex. With free access for up to 10,000 monthly active users, it’s positioned as a scalable solution that grows with your application’s needs.

- 0

8.Ory

8.OryOry is an API-first identity manager. They offer authentication, analytics, access control, machine-to-machine authentication and more. They have SDKs for the major languages: - Dart - .NET - Elixir - Go - Java - JavaScript - PHP - Python - Ruby - Rust Unfortunately, they don't offer a free tier. Pricing starts at $29/month and includes 1,000 daily active users. Then it's $30 / 1,000 additional DAUs.

- 0

4.Best PM Jobs

4.Best PM JobsBest PM Jobs is a specialized job portal designed exclusively for product managers, created by experienced product managers who understand the unique challenges candidates face in their job search. This platform provides early access to top product management roles from leading tech companies, helping candidates apply before the roles get listed on public platforms like LinkedIn or Indeed. Key Features: Our platform offers unrestricted access to verified job listings directly from company websites, ensuring that the roles are accurate and relevant. With a subscription, users can explore all job listings and receive timely job alerts straight to their inbox, keeping them updated on new opportunities without constantly refreshing the portal. We maintain a strict job removal policy, ensuring outdated or filled roles are promptly removed to keep the platform fresh. Additionally, companies can promote their product management openings directly on our job board, targeting a highly engaged audience actively seeking PM roles. How it Works: 1. Subscribe to Best PM Jobs for full access to all PM job listings. 2. Receive new job opportunities in your inbox so you can apply without delay. 3. Search through a curated list of verified roles from leading companies. 4. Get an edge by applying early and avoid the rush of public job platforms. Benefits to Candidates: By using Best PM Jobs, candidates can significantly improve their chances of landing their dream product management role. Early access means they can submit applications before jobs are widely circulated, making them stand out to hiring managers. With verified, targeted listings, subscribers save time and focus only on relevant roles.

- 0

7.MuckBrass

7.MuckBrassMuckBrass brings you closer to great startup ideas by providing a carefully curated list of market-validated startup ideas. Leveraging advanced data analytics, we offer you insights into the latest trends, ensuring that each idea is backed by real-world search volume, competition analysis, and market demand. But we don’t stop at just presenting you with ideas. Our platform empowers you to take your entrepreneurial journey a step further by allowing you to test your own business ideas. With our idea testing tools, you can validate your concepts against key market indicators before you fully commit. By gauging interest, understanding competition, and predicting market fit, you can refine your approach and increase your chances of success. Whether you're an aspiring entrepreneur looking for your next big venture or a seasoned founder seeking to diversify, our comprehensive resource empowers you to make informed decisions. Because where there is muck, there is brass—and we help you find it.

- 2

3.Wellfound

3.WellfoundFormerly known as Angel List Talent, this job board focuses on startup jobs. You can filter by location, remote preferences, salary, equity percentage, years of experience, remote-first companies, investment stage, company size etc. Wellfound allows you to save and name your searches and filters to make job search easier. Finally, you can create a profile and apply for most jobs directly from Wellfound, and companies can discover your profile and reach out to you directly.