Buy Or Skip vs. BondSmartly

Buy Or Skip

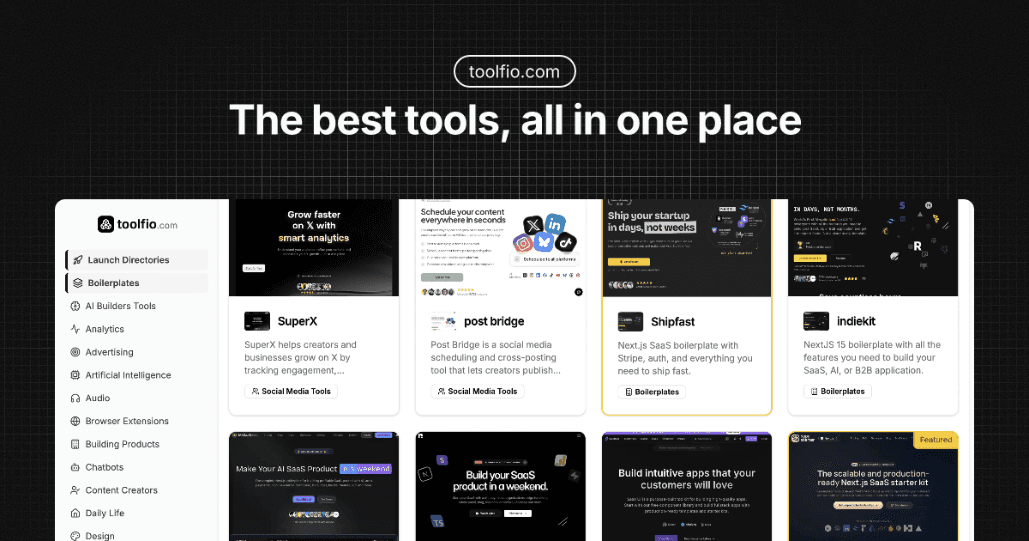

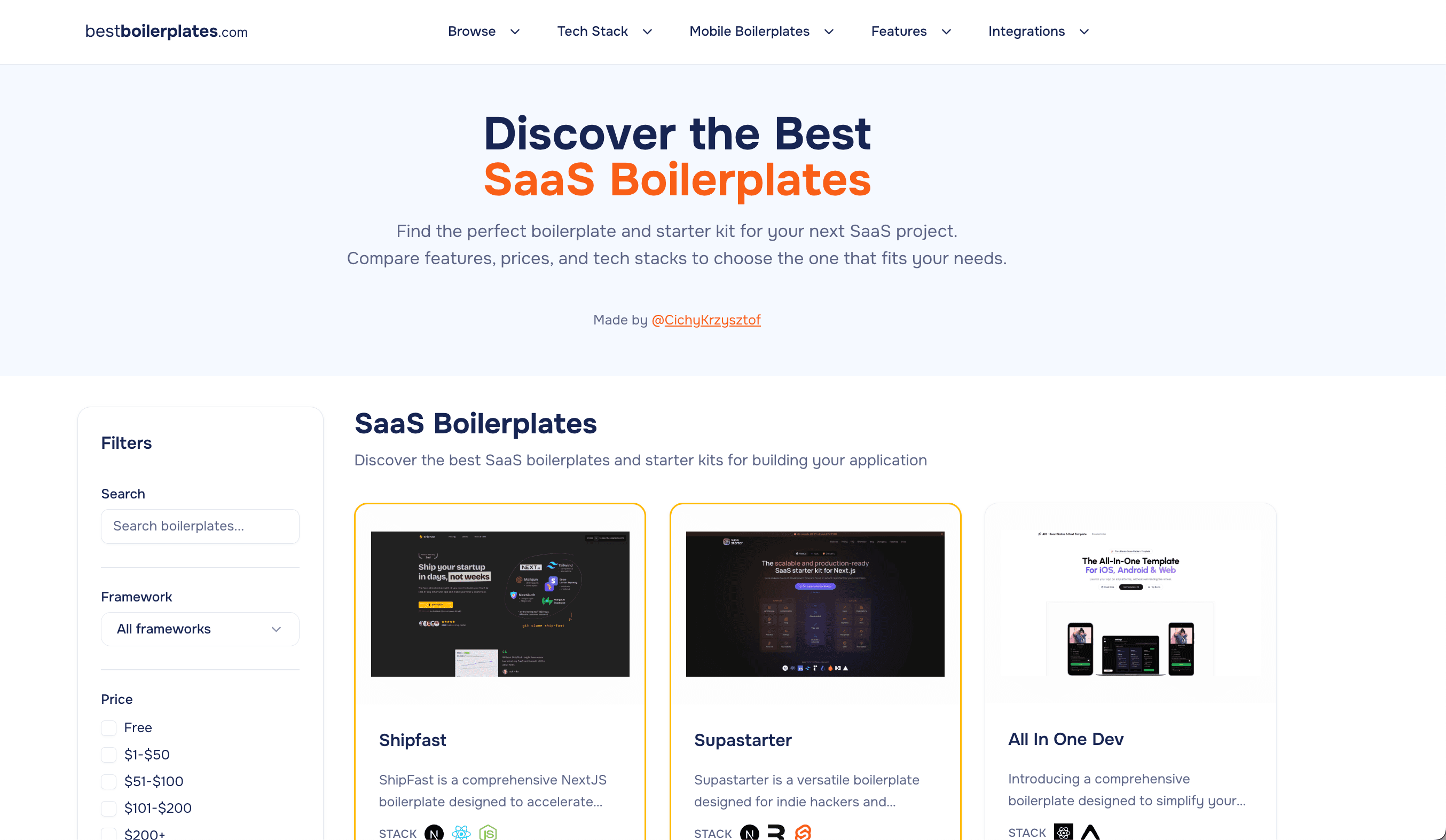

Buy or Skip is a curated collection of deeply researched SaaS tools with the best deals available on the internet. We offer SaaS Reviews, Software Comparisons, and Company Insights to help you make an informed decision.

BondSmartly

BondSmartly.com is a platform designed to streamline bond investment decisions by offering access to yield curves of over 500,000 bonds. It provides users with comprehensive search filters, allowing them to discover using a powerful bonds screener based on various parameters such as ISIN, issuer, coupon rate, and maturity date. Investors can utilize the yield curve data to analyze different bonds and make informed choices. Additionally, the platform features tools like a YTM (Yield to Maturity) calculator and bond screener, making it an all-in-one resource for bond market insights and analytics. With these features, BondSmartly helps investors optimize their portfolios with precision and ease.

Reviews

Reviews

| Item | Votes | Upvote |

|---|---|---|

| No pros yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| Prices for over 500.000 bonds | 1 | |

| Bonds screener | 1 | |

| Reference data for bonds of all types | 1 | |

| Yield curves for all bonds by one issuer. | 1 |

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

Frequently Asked Questions

Buy Or Skip is a curated collection of deeply researched SaaS tools with the best deals available on the internet. They offer SaaS Reviews, Software Comparisons, and Company Insights to help users make informed decisions about software purchases.

On Buy Or Skip, you can find detailed SaaS Reviews, Software Comparisons, and Company Insights. The platform aims to provide deeply researched information to help users make informed decisions about which software tools to purchase.

Buy Or Skip can help you choose SaaS tools by providing deeply researched reviews, comparisons, and insights about various software products. This information can guide you in making informed decisions about which tools offer the best value and meet your specific needs.

BondSmartly.com is a platform designed to streamline bond investment decisions by offering access to yield curves of over 500,000 bonds. It provides users with comprehensive search filters, allowing them to discover using a powerful bonds screener based on various parameters such as ISIN, issuer, coupon rate, and maturity date. Investors can utilize the yield curve data to analyze different bonds and make informed choices. Additionally, the platform features tools like a YTM (Yield to Maturity) calculator and bond screener, making it an all-in-one resource for bond market insights and analytics.

Pros of BondSmartly include prices for over 500,000 bonds, a powerful bonds screener, reference data for bonds of all types, and yield curves for all bonds by one issuer. There are no user-generated cons at this time.

BondSmartly offers several features including a powerful bonds screener based on parameters such as ISIN, issuer, coupon rate, and maturity date. It also provides yield curves for over 500,000 bonds, reference data for bonds of all types, and tools like a YTM (Yield to Maturity) calculator.

BondSmartly helps investors by providing comprehensive tools and data to make informed bond investment decisions. Users can access yield curves for over 500,000 bonds, use a powerful bonds screener to filter based on various parameters, and utilize tools like the YTM calculator to analyze different bonds. This enables investors to optimize their portfolios with precision and ease.